Wall Street has reacted violently to the pandemic, delivering hard blows to people's piggy banks. But there's still talk of traditional valuations relating to stock prices. Let's take a moment to clarify that when an individual buys an extremely small fraction of a company via a stock market, it is not the same as buying a share of Vito's Corner Pizzeria. The commonly used P/E — price to earnings ratio — has always been a useless measurement, and that's true regarding most financial ratios on Wall Street, not to mention mirages caused by creative corporate accounting.

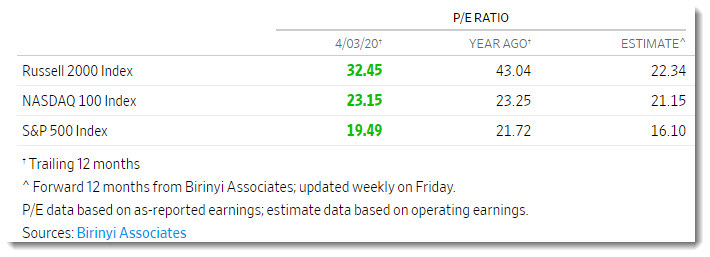

Considering the current unprecedented uncertainty, does the S&P 500 Price/Earnings ratio of 19.49 reflect the increased risk that markets faced 12 months ago when the P/E was 21.72? The lowest P/E of 5.17 was registered in December of 1917, which is a lot closer to reality when buying a local restaurant.

If anything was taught by COVID-19 about the stock market is that psychology always rules the day, not finance or fundamentals. What is not available to the public are the simple and profitable methods to play the stock ponies, and they do not function with large pools of money. If exotic quant investing formulas dominated, hedge funds wouldn't go under, and the typical 2% management fee wouldn't be required when 20% of profits are demanded. Remember LTCM and its PhDs that "nearly collapsed the global financial system in 1998?" Furthermore, the stock market and the economy currently function in a deep sea of debt.

Keynesian economics is a favorite of politicians and Nobel Prize laureates, although they only use half of the recipe. John Maynard Keynes "advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the depression" of the 1930s, known as going into public debt to prime the private economic pump.

The second part of the model, which everyone avoids, is that Keynes expected governments to have balanced budgets or surpluses, avoid debt like the plague, before and after recessions, and he never promoted squandering the hard earned taxpayer money on inefficient government and its projects. Obviously John would have been disappointed with the chart "USA Public Debt & GDP."

While all debt competes for funding and the free market sets interest rates according to supply and demand, perceived risk truly drives the cost of borrowing. That's what credit scores try to establish, reducing your identity to nothing more than a risk value, regardless of whether you're pretty or ugly, short or tall, skinny or fat.

Then interest rates must contend with inflation, deflation, and stagflation, and various strategies are used by central banks to minimize the side effects and bring those pesky numbers to an acceptable, yet arbitrary inflation value of 2%. Why not 3.14159%?

Without diving deep into the inner workings of human psychology, and employing strictly linear, blinder-wearing economic thinking, inflation is defined as too much money chasing too few goods, or an imbalance in supply/demand. Central banks raise short-term interest rates to curtail consumption and decrease demand. But why don't they lower rates to increase supply and meet demand?

On the flip side, deflation is caused by too much supply and not enough demand, and central banks reduce interest rates to stimulate the consumer appetite for all sorts of goods and services, because we consume a lot on credit which is a sin.

Stagflation is yet another economic medical condition, and is defined by price inflation occurring simultaneously with job deflation. But raising interest rates to reduce inflation runs counter to job creation. Conversely, lowering rates to stimulate the economy and employ more people raises inflation, and stagflation is known as an economic pickle.

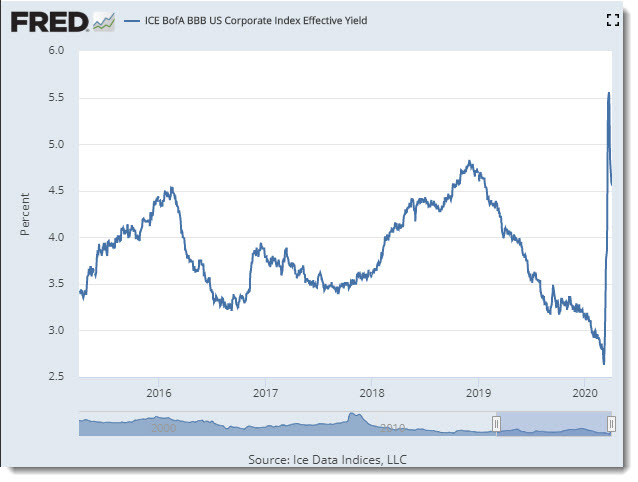

There's an economic condition that has never been experienced, but let's start by pointing that consumer, corporate, and government debt are constantly competing for a place in the Guinness World Records. Blackrock's "Assessing risks in the BBB-rated corporate bond market" sheds light on the issue with its focus on the lowest rated bonds that are one step away from junk.

The investment-grade corporate debt market has grown rapidly in recent years. Global capitalization reached over $10 trillion in 2019 from just over $2 trillion at the start of 2001. In the U.S., corporate debt as a percentage of GDP now stands at 47%, its highest level since 2009. At the same time, the lowest rated part of the investment-grade market has grown particularly quickly. Globally, BBB debt makes up over 50% of the market versus only 17% in 2001.

The precarious debt position cannot be overstated, and it's definitely a bug searching for a windshield. How does all of this risk figure into the P of the P/E ratio? It's complicated.

Obviously the housing crisis of 2008 didn't stop the love affair with debt, and the Federal Reserve along with its army of economists will be defendants in the future Debt Trials. Unfortunately everyone owns a piece of the decaying pie through pensions and retirement accounts.

The chart titled "ICE BofA BBB US Corporate Index Effective Yield" shows how perceived risk drove BBB rates up recently, sinking the investor's principal faster than NASCAR without increasing the interest payment the current holder receives. Although one can hold bonds to maturity, default will derail everyone's bird watching plans, and psychology kicks in again: hold or sell?

All scenarios take place within a trusted monetary system, and absent that, it's complete chaos. So what's worse?

HYDE is the economic scenario that we have never seen. High Yield in Deflationary Environment is a response to extreme risk aversion — human self-interest and survival — where creditors will not lend willy-nilly, interest rates are extremely high, and deflation becomes the norm because people will not consume beyond absolute necessities driven by fear and lack of trust in the future. The ramifications are more extensive, and there's no central bank vaccine for HYDE because psychology beats linear economics and models any day of the millennium. Think of it as Mr. Hyde.