Despite the fact that credit/debt was never designed to be used for consumption, something an Economics degree doesn’t teach, buying tomorrow’s wares today is a big part of America’s happy life, a quotidian practice that has been adopted by the world at large.

We’re living in unusual times, however, and considering that the economy was put in a straight jacket, the March 2020 consumer credit report released in May, courtesy of the Federal Reserve, painted a rare picture. Not only did the coronavirus lockdown virtually stop revolving credit growth, which was somewhat expected, Americans reduced their aggregate credit card debt by a record $28.17 billion. The last time such sizable shift took place was in December of 2015, when credit card debt was reduced by $23.13 billion.

How dependent is the consumer on plastic? While U.S. population grew by 65% between 1968 and 2020 — from 200 million to 330 million people — credit card debt exploded by 81,900%, from $1.31 billion to $1,066 billion. Yet it only increased 7.3% between May 2008 and February 2020 — 12 years of tepid growth that is showing consumer financial stress, potentially driven by memories of 2008.

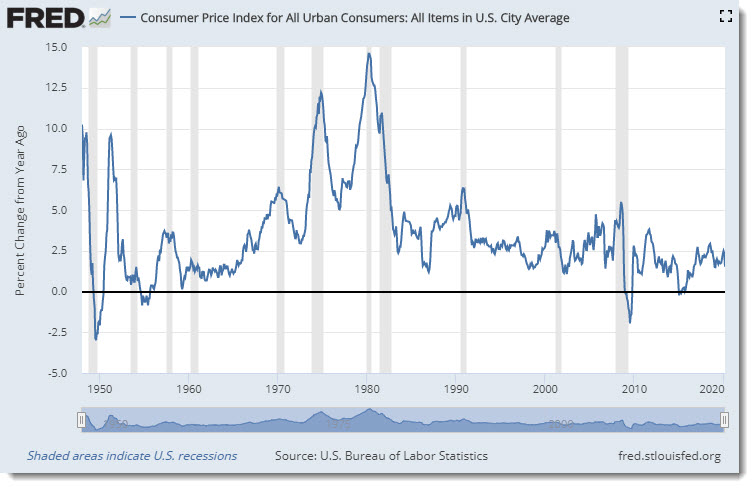

The typical definition of inflation is reduced to the simple chase of too few goods by very fat wallets, and the Consumer Price Index chart depicts “The Great Inflation – 1965-1982,” which was “the greatest failure of American macroeconomic policy in the postwar period,” according to one economist.

As the pandemic of 2020 caused by the coronavirus of 2019 subsides for the time being, the debate now centers on what’s next, from an inflationary perspective. Barron’s provided its own opinion and conclusion with “Expect the Unexpected After the Crisis: Inflation,” which affects investment decisions as everyone knows (or not).

Wartime finances that balloon budget deficits and that are covered by money-printing have proved inflationary throughout history.

So don’t worry that the coronavirus crisis will hurt the credit of Uncle Sam. Instead, prepare for a world very different from that of the past four decades, with rising inflation and interest rates.

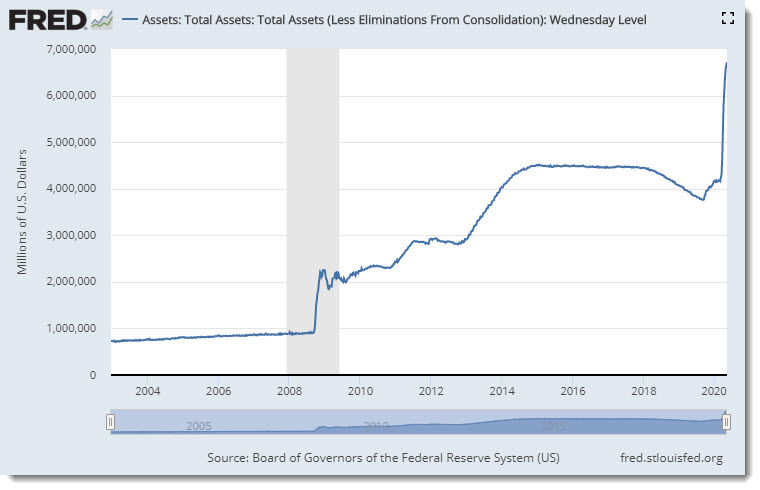

To recap, the Federal Reserve has been at the money printing game since 2008, and its assets have grown sevenfold since then. As illustrated by the Consumer Price Index chart, inflation picked up momentarily in 2008 and then the impact of the Fed’s monetary policy faded into the night, while interest rates have been on a negative slope since the housing crash.

The optimist argument would be that inflation is under control, but that would defy the position of Nobel Laureate Milton Friedman that “inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

But that’s exactly what the Federal Reserve bank has been doing for over a decade without effect. Keep in mind that Friedman was a very astute and practical guy, but not infallible, and in addition he stated that

“The only cure for inflation is to reduce the rate at which total spending is growing.”

That statement implies that the opposite is also true, and the Fed has attempted to stimulate consumption and inflate prices via debt by flooding the market with cheap money. Well, it’s a prime example of why the field of Economics is flawed at best.

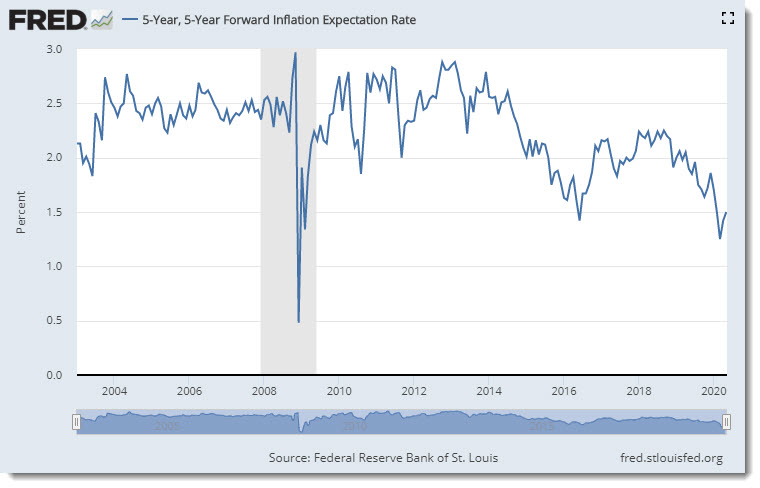

The 5-Year Forward Inflation Expectation Rate is a a measure of expected inflation (on average) over the five-year period that begins five years from today, and considering all the money thrown at the consumer, future increases in the price of goods and services are quite dismal and haven’t reached 3% for a long spell. Why were inflation expectations declining as the economy was humming along?

Psychology is always the economic driver, and unless consumers have faith in the future, spending is curtailed regardless of how much money is thrown at them by the linear, often erroneous Federal Reserve economic models and formulas.

Going forward, Americans have never seen their lives turned upside down so fast and to such an extent, including the Great Recession of 2008, Great Depression of the 1930s, and World War II. Over 30 million people lost their jobs in less than 60 days, and that was a game changer that will be permanently engraved in the psyche of everyone, including those that still draw a paycheck.

The pandemic debacle accelerated the underlying deflationary condition, and fear of destitution is stronger than fear of death. Consumers will not be in the mood to spend because the fear of unexpected economic disruption is now extreme, and human self-interest always rules everyone’s actions.

There are pros and cons to everything we do, and the pandemic lockdown is no different. With that in mind and in addition to questioning the high cost and usefulness of 2/3 of college degrees, here are three major items that corporations, citizens and even governments will reevaluate, and the outcome will affect investments for generations.

- Urban and commercial real estate and its utility;

- All travel necessity and alternatives;

- All discretionary spending.

Lastly, many white collar jobs will not come back as corporations will no longer create or restaff empty positions that cater to non-profitable fluff — leadership training, change management, diversity and inclusion, and whatever the fad of the day may be — and layers in the management pyramid will be removed. Please plan accordingly.