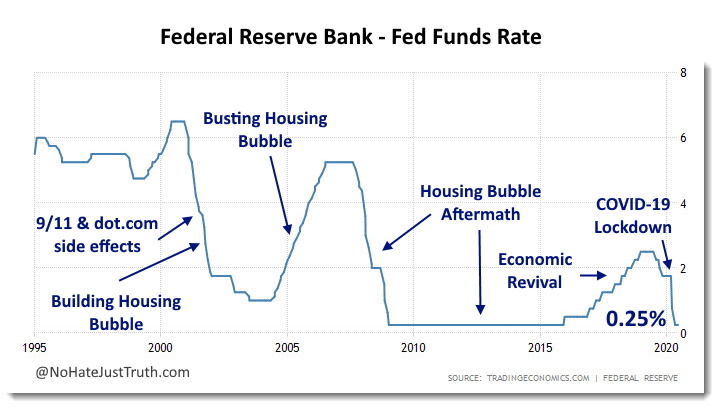

In the aftermath of the 2008 housing debacle, central banks (CBs) engaged in an interest rate reduction marathon to stimulate economic engines and the practice is still alive 12 years later. Needless to say, the U.S. Federal Reserve Bank (Fed) built and then busted the housing bubble all on its own, after fighting the side effects of the dot.com speculative game and the economic fallout of the terrorist attack on September 11, 2001.

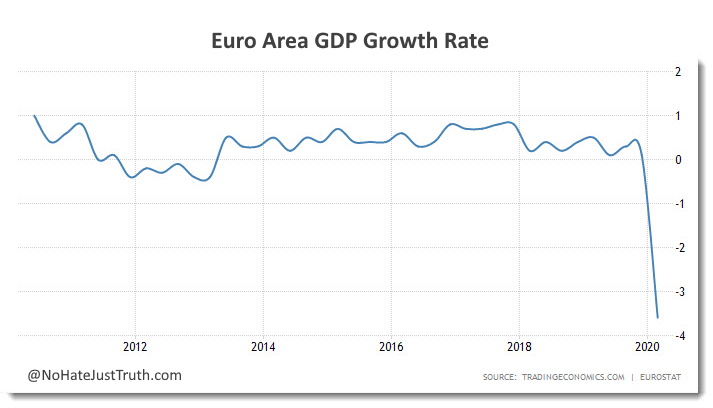

While the U.S. had somewhat recovered by 2016 from the economic blowout of a decade ago, the Eurozone never truly saw the light at the end of the tunnel. As a result the European Central Bank (ECB) embraced negative rates on June 11, 2014 and never looked back.

Besides being a negative number, what is a negative rate? It’s a penalty for parking cash at a bank, which, in the mind of economists, is an incentive to invest and spend that will stimulate the economy. But then risk mitigation kicks in and one must decide whether paying a small fee to a bank for holding one’s money is the lesser of two evils, opposed to losing a large chunk of an investment or loan portfolio in a precarious economic environment. Or is consumer spending on new cars, fancy food and footwear a wise move if confidence in the future is bleak and one’s job prospects seems uncertain?

It’s always about psychology and human self-interest, and economists simply don’t get it. They view the world through linear thinking and often mesmerizingly mind boggling formulas and models that continuously fail, decade in and decade out, although some do collect Nobel Prizes for their work. Lucky them!

Considering the ECB’s negative rate decision 6 years ago, the Euro Area’s GDP growth rate is hardly a picture of beauty. It hasn’t breached 1% despite subzero interest rates, and looking at the chart above, it’s obvious that negative interest rates had no meaningful impact on economic growth. For clarity, the recent drop in GDP is related to COVID-19 pandemic shutdown.

However, buying Exchange-Traded Funds (ETFs) by CBs and propping the stock market is yet another tactic — “Bank of Japan’s Bond and Stock Holdings Top 100% of GDP” in 2018 — hoping that people will feel wealthier on paper and will borrow and spend mindlessly. At this pace, it won’t be long before central banks will own every single bond on Earth, or so it will appear, distorting the free market pricing mechanisms. So much for economic models!

Only a few days ago, and using COVID-19 induced economic lockdown as the pretext, “European Central Bank takes its pandemic bond buying to 1.35 trillion euros to try to prop up economy,” defying logic as countries are still in virtual lockdown. In addition, “The Fed is starting its program to purchase corporate bond ETFs” as if there aren’t pros and cons to everything we do.

Please note that the first chart titled “Federal Reserve Bank – Fed Funds Rate Annotated” gives us a feel of how inefficient CBs truly are as they constantly chase their tails and meddle in affairs that, ironically, they don’t comprehend. As psychologist Abraham Maslow said in 1966, “I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail.”

CBs also missed the memo that “free market” means that winners and losers are determined by market forces — supply and demand as it were — and constant central bank interference is not a panacea and has unpleasant ramifications.

Going forward, the investment risk will be exposed when credit markets cease to chase bond prices in search of a few basis points to satisfy their ROI appetite — it’s coming soon — and will demand much higher rates while refusing to finance debt below Standard & Poors A- rating (Moody’s A3). Interest rates will rise like a Phoenix and principal will vanish because default will be as common as oxygen as new bond offerings needed to refinance existing debt will falter. This time we’ll have hyperinflation interest rates with a deflationary environment as outlined in “Wall Street, Keynes, Debt And HYDE.”

HYDE is the economic scenario that we have never seen. High Yield in Deflationary Environment is a response to extreme risk aversion — human self-interest and survival — where creditors will not lend willy-nilly, interest rates are extremely high, and deflation becomes the norm because people will not consume beyond absolute necessities driven by fear and lack of trust in the future. The ramifications are more extensive, and there’s no central bank vaccine for HYDE because psychology beats linear economics and models any day of the millenium. Think of it as Mr. Hyde.

Beyond the unavoidable market mechanisms, the simpler point that is overlooked is that negative interest rates have a negative psychological effect on confidence, and that’s why everyone tries to avoid deflation: It feeds on itself. If the expert economists don’t believe in the economic prowess of society without resorting to exotic strategies, why would the common person have confidence in the future?

Markets will eventually ignore central bankers and, to further paint CBs into a corner, government debt will continue to create unbelievable demand while CBs cannot go on a money printing spree or we will turn into Zimbabwe or the Weimar Republic. Confidence in the monetary system cannot be compromised or the best selling item at Home Depot will become the wheelbarrow.

However, the quest for remedies to mend the errors of the past will continue unabated driven by exuberance and arrogance, and increasingly sillier approaches will surface while the debt tide mostly accumulated to finance social nirvana and wasteful government continues to erode the economic foundation below our feet.

To be negative interest rates or not to be? We’re in Act III of the Interest Rate play, and unlike Shakespeare’s Hamlet, a tragedy, there will not be Acts IV and V. Unless one is trading bonds on a very tight timeframe and for price appreciation only, disposing of all debt instruments at this stage is the wisest move of the century.