Western civilization has become extremely addicted to credit, the financial instrument that is widely abused by governments and consumers alike. The condition has been exacerbated since the outsourcing to Asia began in the 1990s, mostly due to the evaporation of manufacturing jobs as the quest for cheap labor persisted. As consumer credit exploded, politicians continued to promise all the free goodies to their voters and donors, and the march to infinite debt levels on all fronts hasn’t subsided. Yet!

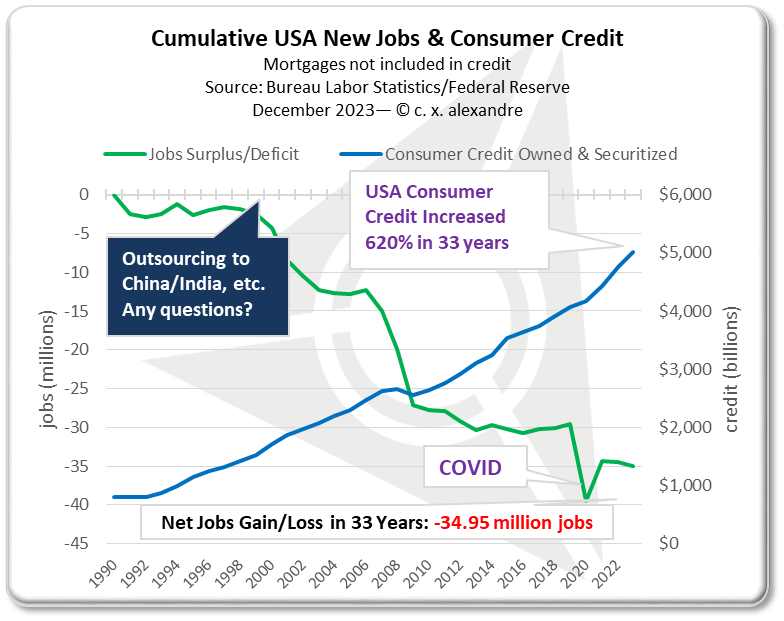

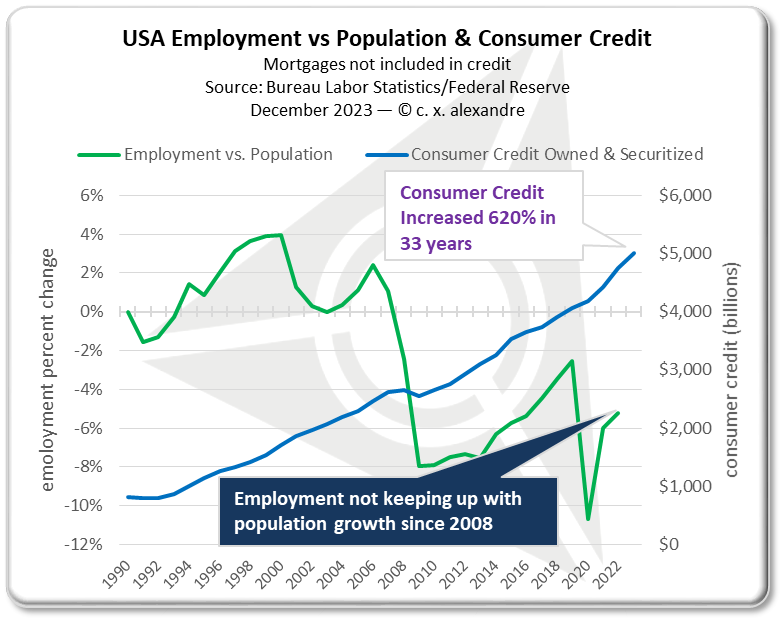

As the US economy lost close to 35 million jobs (of all types, not just manufacturing) in the last 33 years, consumer credit (debt) increased 620% over the same time to $5 trillion, excluding mortgages, and a PhD is not required to quickly determine that the disconnect between earnings and spending is beyond sustainable. Meanwhile employment hasn’t kept up with population growth since 2008, exacerbating the financial squeeze.

Must now refer back to “1959: The Year Economics Changed And Nobody Noticed” as a refresher for a better understanding of consumer credit.

So why 1959? That is the year that credit cards with revolving credit lines were introduced, and the shift of future consumption into the present started to infiltrate the consumer’s consciousness. While financing major purchases and acquiring “needs” within reason, much like the mortgage did in 1934, can be at times justified, the practice transitioned into financing “wants” and keeping up with the Joneses. Truth be told, consuming future “needs” or “wants” today magnifies the side effects when a disruptive economic event occurs, and humanity as a group cannot see well into the future and assess the ramifications of today’s choices. But this is not strictly an American story because U.S. consumer debt financed global economies.

At this juncture we’re financing daily “needs” because for many that is the only way to survive, and as credit limits are being reached, lender risk management protocols indicate that the majority of those limits cannot be increased. Thus the introduction of BNPL — Buy Now Pay Later — which is the last step before the entire house of credit cards comes crashing down. It’s nothing more than a new name for a credit card without the revolving credit feature. Here’s the BNPL usage reasoning as described in “3 reasons why declined transactions explain the rise in BNPL adoption“:

Moreover, if a customer hits their credit limit, or would with a purchase and are not permitted by their bank to make that purchase, it becomes a choice of last resort. In that case, making smaller payments over the course of a few months, generally without interest or surcharges, becomes a particularly appealing workaround.

The headline “BNPL companies face grim outlook, Moody’s says” paints a clear picture, which then expands to point out “persistent losses.” The economic reasoning behind the adoption of BNPL was once again highlighted in this article dated November 13, 2023.

BNPL benefited from a surge in online consumer demand for installment financing services during the pandemic, and more recently, some consumers are turning to it in the face of tough economic conditions.

From a future socio-economic perspective, as people start to default and credit lines are denied en mass, businesses start selling and producing less, leading to unemployment and lower taxation, thus becoming a vicious cycle with no end in sight. The process will claim the comfortable living of millions, leading to social unrest at the extreme because we’ve reached the point of no return.

Add millions of mostly illegal immigrants — legality makes no difference — that are in essence escaping the socialist failures of their countries, with the great majority seeking handouts because they lack the skills to be productive members of society within Western Civilization, and the problem compounds itself exponentially. Then add the existing welfare state to the equation, and there’s only one logical conclusion — and it doesn’t have to be spelled out for you.

One obscure economic indicator is the Velocity of Money, with the period between Q1-1959 and Q3-2023 shown above. Investopedia has a simple definition and explanation.

Economies that exhibit a higher velocity of money relative to others tend to be more developed. The velocity of money is also known to fluctuate with business cycles. When an economy is in an expansion, consumers and businesses tend to more readily spend money causing the velocity of money to increase. When an economy is contracting, consumers and businesses are usually more reluctant to spend and the velocity of money is lower.

The Velocity of Money value in Q3-1997 was 2.192 with the last reading in 2023 at only 1.326, or 39% lower. In addition, 2023 was 22% lower than the average of roughly 1.7 between 1960 and 1990, clearly showing a long-term problem. The chart above also gives a visual clue as to the weakness of the US economy which aligns with the loss of 34.95 million jobs since the US started to outsource manufacturing and services to China, India, and the 3rd world in general. But nobody talks about it because debt continues to finance the economic shortcomings.

Regardless of the nonsense and “massaged” statistics that politicians and bureaucrats deliver to the people every single day, the raw economic numbers and the weight of people’s wallets do not lie. Here’s a glimpse of the consumer condition taken in a 2023 survey

Data from a June survey conducted by personal finance software company Quicken revealed that 32% of Americans earning at least $150,000 a year are currently living paycheck to paycheck, while 36% of folks earning $50,000 to $150,000 and 55% of households earning less than that reported the same.

Eventually FICO credit scores will become meaningless. Those that will need credit will not get it because of very low scores, and those with high scores will not be borrowing or spending, paralyzed out of fear. It’s human nature. And there’s yet another side to this story: higher interest rates driven by risk and government demand to service the existing and still growing debt will add the final nails to the coffin. But that’s a topic for another day, with The Greatest Depression well on its way.