We often discuss federal deficits and debt, but what is kept in the shadows is that U.S. states have their own unmitigated indebtedness fueled by years of mismanagement, with some facing the prospect of bankruptcy. As the COVID-19 panic continues to impact economic output and people’s paychecks, states are suffering greatly from extremely reduced revenue. After all, government doesn’t produce anything and depends on taxes from its productive citizens.

The current narrative is that the economic situation created by the coronavirus is responsible for the states dire financial conditions. That’s a blatant lie.

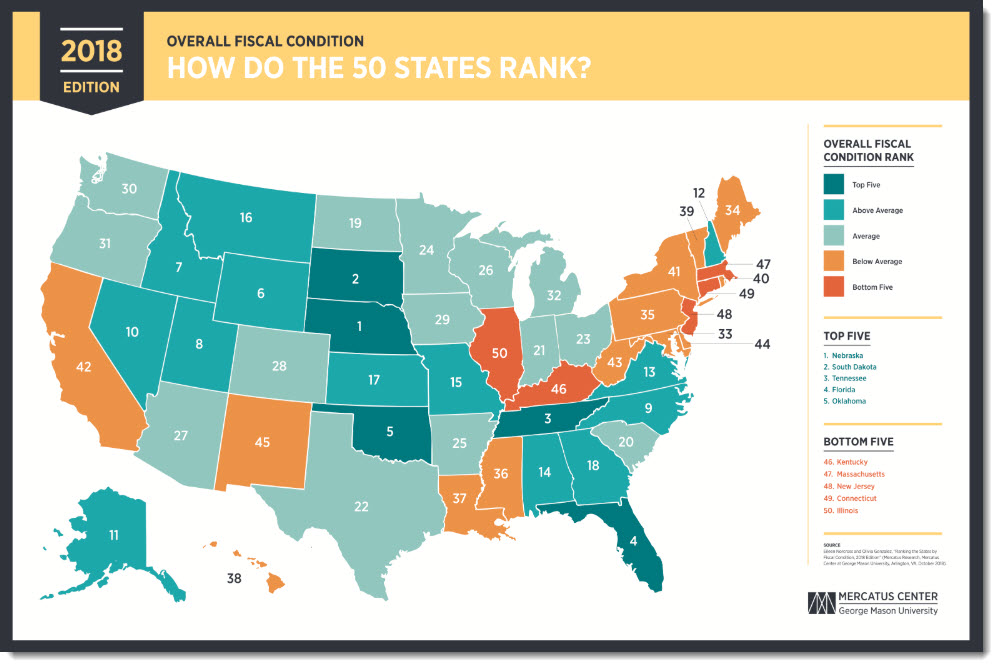

The Mercatus Center at George Mason University ranks the 50 states according to their financial condition, and the picture was already unpleasant as shown by the 2018 report, which used older data.

In “Ranking the States by Fiscal Condition, 2018 Edition,” Eileen Norcross and Olivia Gonzalez calculate this year’s rankings from each state’s fiscal year 2016 reports and then apply trend analysis to reports for each year from 2006 until 2016.

What is simple but never on the news is that the higher risk of default triggers higher borrowing costs, which leads to higher taxes, reduced government spending, or both. People can relate through their FICO scores and credit card interest rates. In addition, states ignore or deliberately underestimate unfunded liabilities such as future pension obligations, which is not different than being in a complete state of denial about your car loan until the bank takes your ride away.

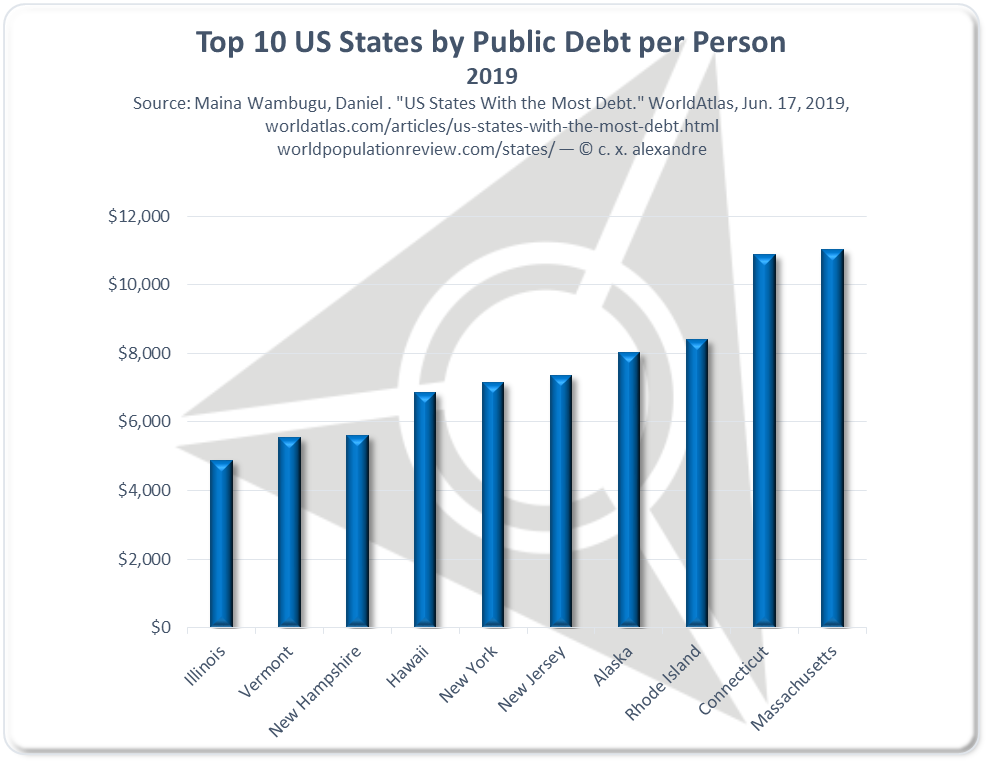

When Illinois, the worst offender in the union, is confronted with an unforeseen emergency while on the brink of disaster, “state officials are scrambling – largely by phone – to try and figure out how to manage Illinois’ already precarious financial situation.”

A rainy day fund that one state official says couldn’t fund state government for 30 seconds. An epic budget impasse that devastated state finances. And $134 billion in unfunded pensions liabilities. And that was before a pandemic crippled Illinois’ – and everyone else’s – economy.

Obviously U.S. states cannot print money, and that brings us to the recent call for the federal government to feed the states’ large debt appetite, adding to the pile of U.S.A IOUs the feds already signed.

While keeping in mind that Kentucky is the 46th state with the worst fiscal problems, its senator Mitch McConnell suggested that states should go bankrupt.

McConnell, whose Republican Party controls the Senate, on Wednesday poured cold water on efforts by Democrats to tap federal coffers to provide assistance to state and local governments.

New York governor Andrew Cuomo, a Democrat, countered candidly.

“This is one of the really dumb ideas of all time,” Cuomo said at his daily news briefing. “Not to fund state and local governments is incredibly short-sighted.

Make no mistake about it: a political calculation is in play on both sides, with four states out of the Bottom Five in the Mercatus report currently controlled by Democrats. In addition, states love to invoke the 10th amendment until they need money from Washington D.C.

However, and politics aside, nobody is addressing the root cause of the current fiscal condition, which would expose pervasive government incompetence and the complete disregard for the taxpayers’ well-being, with only those that never pay taxes or feed off the welfare spigot not interested in the details.

But it gets complicated when debt is presented as a personal liability, and we weight the ability and willingness of the citizens of each state to sustain the government’s spending addiction. That will come later, and that’s in addition to the $68,300 public debt per person already incurred by the federal government, illustrated in “Debt, People & Politics.”

Suffice it to say, somebody will pick up the bill one way or another, and sooner than people realize. In addition, corporations will eventually relocate to states with lower tax burdens, because the human self-interest of their shareholders always rules the day.

Let’s not forget that all kinds of pensions across America are under extreme pressure to seek the much coveted 7% returns required to feed pension demands as interest rates hover around 0%. Money managers and administrators depend on the stock market and other exotic, high risk investments like junk bonds, and often via hedge funds that take a 2% management fee off the top. Bitcoin anyone? Self-managed retirement accounts are in the same exact boat.

But why not pursue bankruptcy? Because somebody is holding state bonds and debt, and your pension may be the loser, which transfers to you, unleashing political ramifications that will further complicate matters for the political class.

As a small example, here’s a partial list of Illinois bond holders in 2017, providing the initial strokes needed to get the big picture on the canvas: Fidelity Investments, Vanguard Group Inc., Nuveen Investments, Dodge & Cox, AllianceBernstein LP, Wells Fargo Asset Management, and BlackRock Inc. held a total of almost $6 billion.

In addition, market access to future funding is restricted by perceived and real risk, which either means “no soup for you,” or very high interest rates and crippling debt payments that must be serviced through higher taxes and reduced spending — and you still run the risk of losing your pension and investment. It’s the destructive HY in HYDE as defined in “Wall Street, Keynes, Debt And HYDE.”

Even federal debt will cease to expand at some point and people will be extremely upset and aggressive when they eventually discover the driver behind the huge government party bill that they will face.