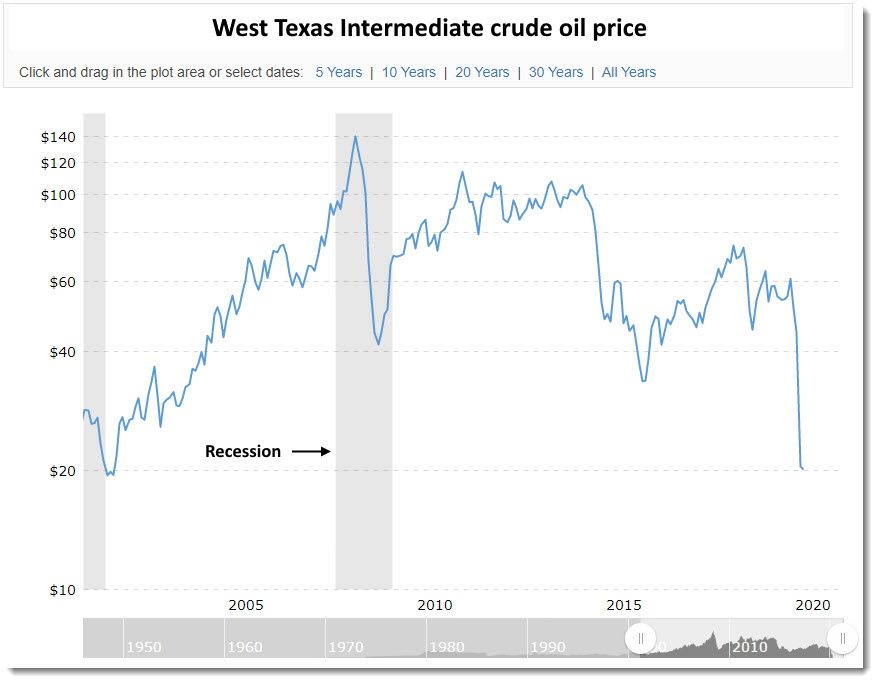

Nearly twelve years ago Goldman Sachs once again ventured into the crystal ball business with a prediction that a “‘Super-spike’ could lift oil to $200” as the price registered $121 on May 6, 2008. The price rose to $140 by June 2008, smack in the middle of an obviously invisible recession at the time, and then crashed to $41 on January 2009. They didn’t realize that the wind beneath the oil price wings was fading quickly as the U.S. housing debacle was spreading. So much for markets discounting the future.

Let it be known that investment banks make their money on fees, not tarot card reading, and their research departments are usually so deep into the weeds with vision distorting charts and trend lines, that they miss the forest entirely. But it’s all just fun and games and for public consumption, and by the time one figures it out, the non-refundable toll fee has been collected.

Now, in the midst of the coronavirus confusion, everyone is rushing to adjust their forecasts after oil sunk over 60% in less than 70 days.

Morgan Stanley raised its third-quarter Brent and WTI price forecasts to $30 per barrel from $25, and to $27.50 per barrel from $22.50, respectively. It likewise raised its fourth-quarter outlook by $5 per barrel for both crude benchmarks, to $35 for Brent and $32.50 for WTI.

On February 3, 2020, Bloomberg’s article titled “China Oil Demand Has Plunged 20% Because of the Virus Lockdown” caused the price for West Texas Intermediate to decline as much as 2.2% for the day, although the price rose 7% over the next two weeks despite a travel ban from China imposed by the U.S.

Chinese oil demand has dropped by about 3 million barrels a day, or 20% of total consumption, as the coronavirus squeezes the economy, according to people with inside knowledge of the country’s energy industry. The drop is probably the largest demand shock the oil market has suffered since the global financial crisis of 2008 to 2009, and the most sudden since the Sept. 11 attacks.

However the swift 20% price decline over the previous 30 days wasn’t explained, and didn’t affect Wall Street’s forecasts until the coronavirus became the major headline. Some will opine that low oil prices are part of Russia’s plan to disrupt and bankrupt American oil business, but oil and gas account for more than 60% of Russia’s exports, and provide more than 30% of Russia’s GDP. Hardly a logical explanation, or shooting yourself on the foot as the clever strategy to killing your enemy!

Much like 2008, there’s something in the works that has evaded the public eye and apparently Wall Street as well, and that’s the fact that China’s economy was already imploding before the pandemic. That’s why the Communists rushed to cover up the Wuhan virus as quickly as possible, regardless of how it started — bats, dogs, chopsticks… who gives a Peking duck?

And who would want to continue doing business with people that are continually prone to increasingly infectious and deadly diseases as indicated in “Coronavirus: Quarantine Is The New Segregation.”

We know that viruses — COVID-19, SARS, MERS, Ebola, and the already forgotten West Nile and Zika — had a geographic origin in Asia and Africa, and ignoring the implied message is hardly a clever move.

Wall Street didn’t understand back in 2008 that the fading housing craziness fueled by the political insanity of “a house in every pot at any cost” was the cause for the rise in the oil price, as they don’t realize today that the underlying structural demise of oil is China’s sinking economy. As the mountains of empty apartments, bridges to nowhere, and bad debt throughout China continue to be ignored, the Politburo is addicted to publishing erroneous and worthless economic data designed to paint a far rosier picture. After all, they have the highest IQ.

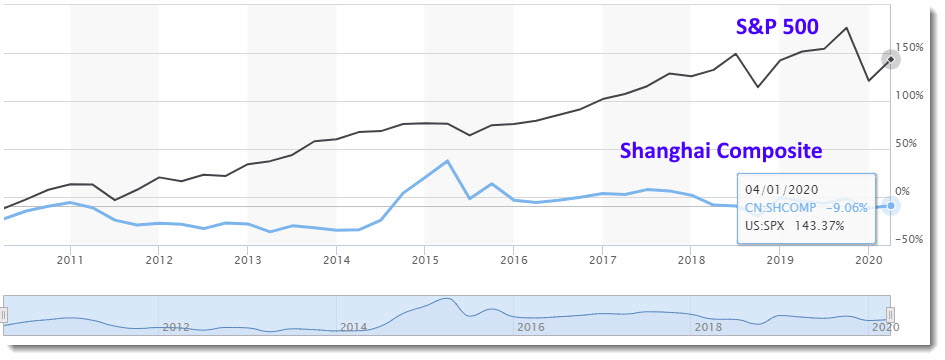

The S&P 500 and Shanghai Composite indices over the last 10 years deliver the contrast between the U.S. and China, and market psychology drives pricing, which is driven by perceptions about the underlying economy. While China never recovered from the side effects of the 2008 debacle, it still depends on Western Civilization and always will, because an economy is a reflection of the aggregate intellect.

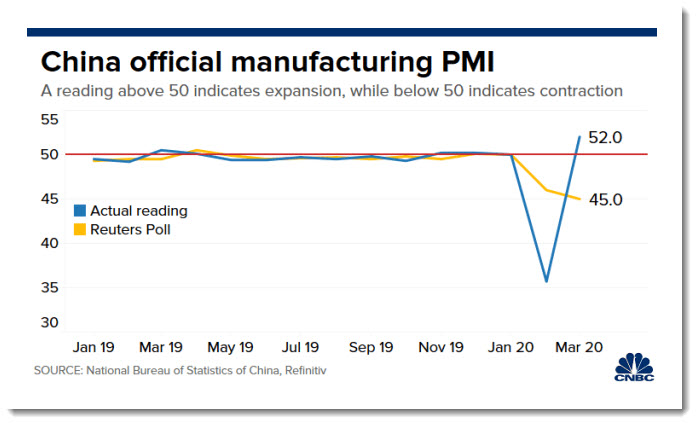

To illustrate Chinese crapola, let’s take the Purchasing Manager’s Index (PMI), where readings above 50 indicate economic expansion, and those below that level signal contraction. China’s official manufacturing PMI jumped to 52.0 in March 2020 from the February’s record low of 35.7, or resuming growth while the country was on lockdown. Must have been all those colorful and powerful Chinese dragons firing on all cylinders.

China’s economic fears already started to materialize, with “Japan to pay firms to leave China, relocate production elsewhere as part of coronavirus stimulus.” Others will follow, including the good old USA, bringing to the fore whether China’s much advertised economic and intellectual prowess is real or a mirage per “China IQ Myth And The Huawei Way.”

Lastly, and bluntly speaking, China’s biggest problem is vast, easily identifiable, and fills its borders: Chinese people. “It’s Realism, Not Racism,” and please plan accordingly.

P.S.: Caxin reported that “European Manufacturers Not Eager to Exit China, Head of EU Chamber Says,” the “world’s biggest manufacturing nation.” Please note that China’s consumer market is not the focus because it will not function on its own without Western outsourcing.